Can you be sure that your Managed Portfolio Service (MPS) provider has what it takes to meet the ever-evolving regulatory criteria?

The FCA’s Consumer Duty directive, which came into effect in July 2023, is causing advisers to appraise and realign their processes and propositions. In the following five questions, we outline what to look out for to ensure that your clients are getting the best outcomes from your chosen Managed Portfolio Service (MPS).

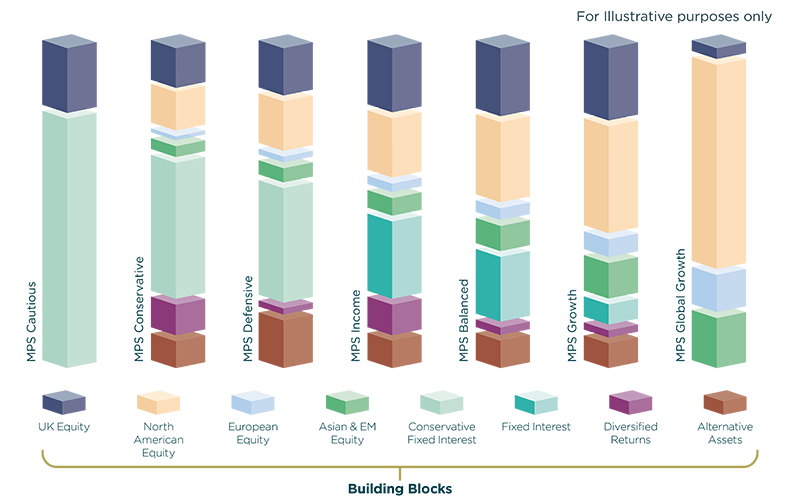

At Quilter Cheviot, our innovative ‘Building Blocks’ approach to portfolio construction provides key benefits for advisers and their clients. The structure gives our fund managers greater flexibility at a lower cost, so they have complete freedom to base investment decisions on the quality of investments, rather than the cost of the investments.

Now is the time to review your MPS providers to make sure they have the right answers to the following five questions.

MPS due diligence webinar

Key questions to ask your MPS provider

Join Quilter Cheviot’s Head of MPS, Simon Doherty and Mike Barrett from the Lang Cat, as they discuss market changes, the minefield advisers have to navigate with due diligence and Consumer Duty, and the key things for advisers to consider to manage their MPS due diligence.

Our MPS strategies

Find your local Business Development Manager

Your Business Development Manager is on hand to answer any questions you may have, as well as to support you throughout your relationship with Quilter Cheviot.