Time in the market beats timing the market

This well-known maxim encapsulates arguably the most important piece of investment advice – to stay invested - and is particularly timely given the current environment and recent drops in both equities and bonds. Evidence shows that remaining invested for the long term is one of the best things you can do for your overall wealth.

After a bright start to 2025, global stock markets came under pressure around the end of the first quarter as Donald Trump took aim at the international trade order with a wide-ranging series of punitive tariffs.

However, investors should maintain a long-term horizon and look through short-term headwinds. Staying invested allows you to benefit from the growth in businesses and the economy over time, and while it can be tempting to take money out of the market in the short term, history shows it is highly likely to deliver lower returns overall.

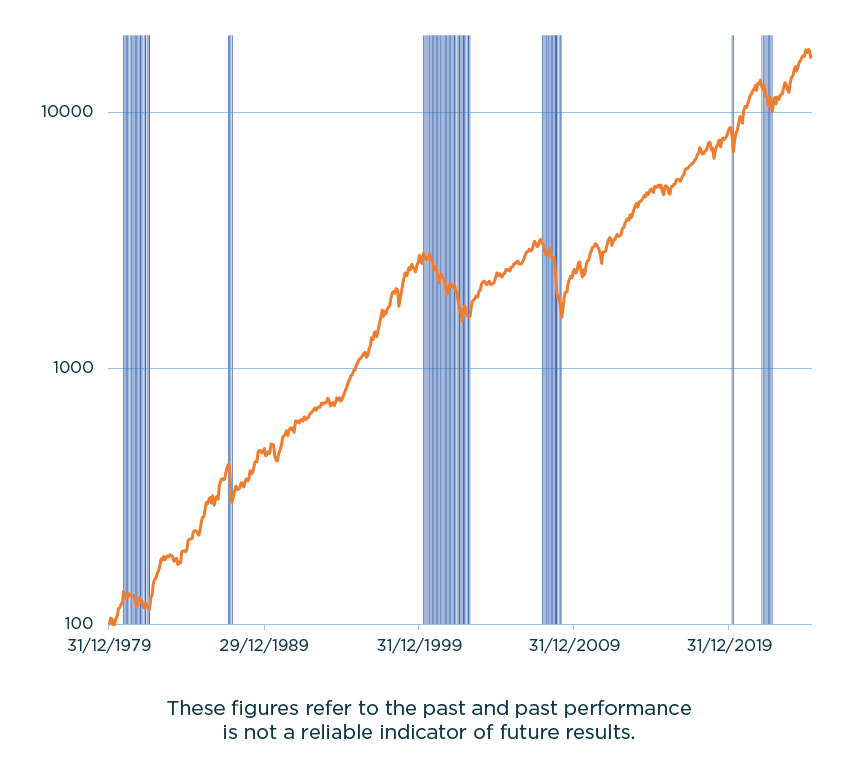

Markets trend up over time, despite several bear markets

Markets trend up over time, despite several bear markets

Our first chart shows the performance of US shares from the end of December 1979 to the end of March 2025. Overall, the picture is encouraging with investors enjoying positive returns during the period, despite several significant declines along the way - the market experienced several bear markets, defined as a market decline of 20% or more. The average peak to trough decline lasted 13 months, while on average it took 19 months to subsequently recover from a trough to the previous peak. Downturns are not rare events and typical investors, in all markets, will experience many bear markets during their lifetime.

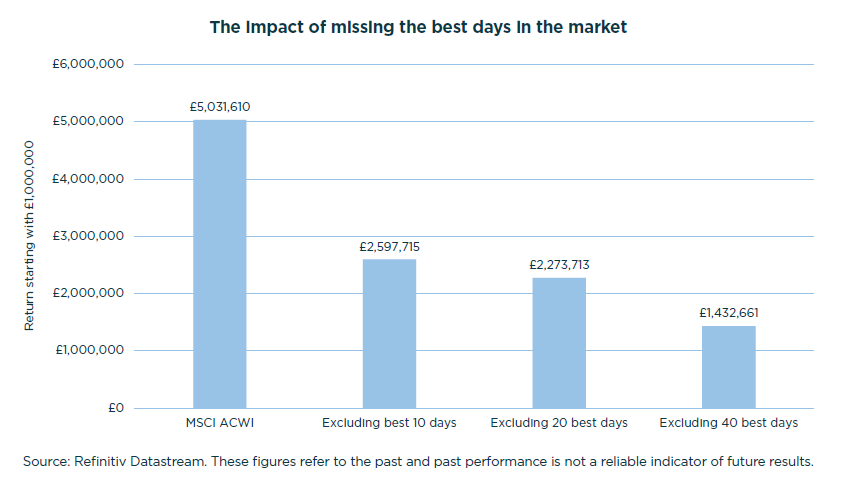

This demonstrates the negative impact of missing the best days in the market. While it might seem preferable to avoid bear markets, many of the largest daily gains occur during these periods. Missing these days by divesting into cash would have a clear and significant detrimental impact on your overall returns.

The bar on the left-hand side shows how much a £1m portfolio invested in global equities (reinvesting dividends – see chart below) at the start of the year 2000 would be worth now – it would have more than doubled. The bars to the right show how much your portfolio would be worth had you missed the best 10, 20 and 40 days in the market.

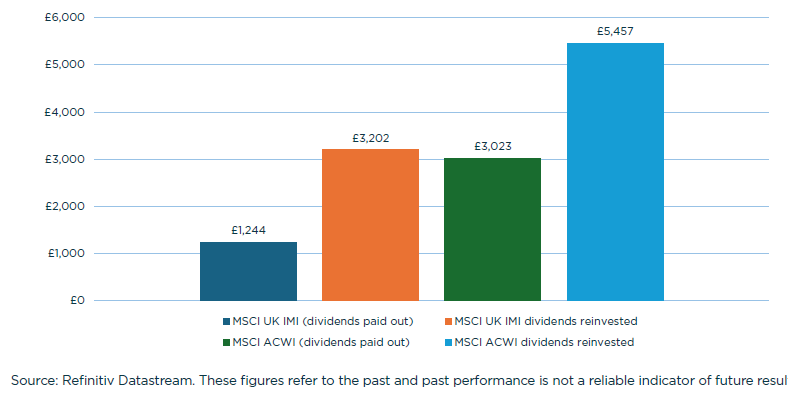

The dividend difference

Dividends are payments made by companies to shareholders and can account for an extremely significant portion of longterm returns. Reinvesting these dividends allows them to compound and can provide a major increase to overall returns. For instance, reinvesting dividends can more than double the overall return, as has been the case for UK indices since the turn of the millennium. The following chart shows the performance of £1,000 invested into UK shares and £1,000 invested into global shares, with dividends reinvested or paid out from the end of December 1999 to the end of March 2025.

Reinvesting dividends can make a significant difference to overall returns

Critically, dividends are often paid at regular intervals and therefore if you try to time your entry in and out of markets, you may miss these payments (there can also be minimum holding periods to receive dividends). Missing dividend payments would have severely diminished your investment returns over the past 25 years – for the UK you would have received the returns in dark blue rather than orange and for global equities you would have received the returns in green rather than light blue.

Conclusion

In conclusion, there have been clear benefits to remaining invested over the past 40 years. Historical results should not be seen as a guarantee of future performance, but the rationale behind this approach is sound. Looking through short-term volatility and maintaining a long-term focus has proven to be a winning strategy, largely due to not missing the best days in the market and the reinvestment of dividends.