It’s been a difficult couple of years for financial markets, albeit the last month or so has provided some green shoots of optimism with inflation continuing to fall and interest rate expectations moderating. Few places have been hit as hard as the UK small- and mid-cap markets with the Numis Smaller Companies Index – which covers the bottom 10% of the UK main listed market – down over 30% from its peak during the pandemic.

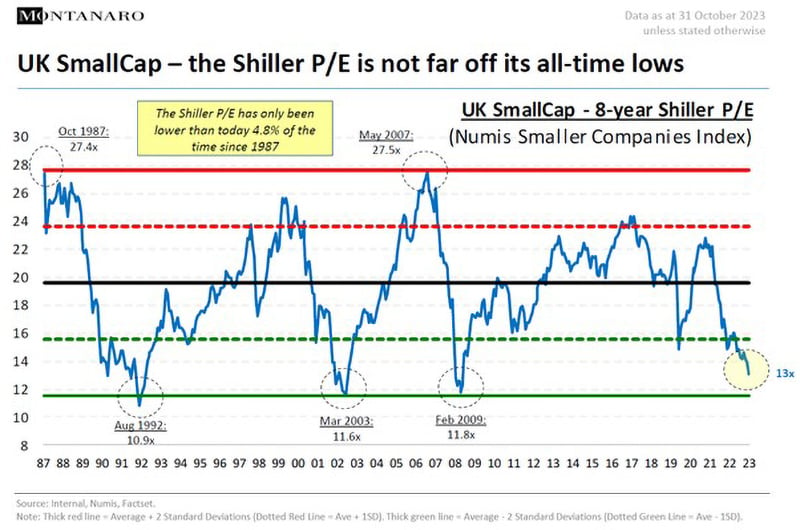

Valuations (i.e. how “cheap” or “expensive” share prices are in comparison to the aggregate profits they generate) in the UK “small cap” market are illustrated by the following chart from the asset manager Montanaro:

Current valuation levels are in line with the nadirs from 2003, 2009 and 1992. All those periods proved to be good entry points into UK small cap. Indeed, recent months have seen numerous takeovers of UK smaller companies: notably chocolate shop Hotel Chocolat and pub company, The City Pub Group, both for meaningful premia over their share prices. It is clear that there is a significant amount of value in UK small cap and the market is showing some tentative signs of revival.

There remains the possibility of a recession in the UK as the impact of higher interest rates bite on households and businesses. A recessionary environment could well see further weakness for UK smaller companies as they tend to be relatively more sensitive to the economic cycle, but valuations are already discounting a lot of bad news.

This is a marketing communication and is not independent investment research. Financial Instruments referred to are not subject to a prohibition on dealing ahead of the dissemination marketing communications. Any reference to any securities or instruments is not a personal recommendation and it should not be regarded as a solicitation or an offer to buy or sell any securities or instruments mentioned in it

--

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com)

Subscribe to Taking Stock - Diary of an Investment Manager

Get the inside view from Quilter Cheviot Investment Manager, Jonathan Raymond, in his fortnightly diary.