Inflation remains at the forefront of investors’ minds, with already rising price pressures recently receiving a further boost from soaring commodity markets.

First quarter financial results for most public companies will soon be released and the impact of rampant inflation will no doubt be closely scrutinised.

Equities traditionally continue to perform relatively well during bouts of inflation, largely thanks to their ability as a “real” asset class to pass higher input costs on to consumers, meaning company revenues, earnings and dividends also rise. Historically, equities offer the largest real returns in modest inflationary environments but start to underperform gold, commodities and real estate if inflation runs above 5%, according to 150 years of US data. Still, even when inflation is running hot and above 5%, real equity returns have still been positive during this time period.

Inflation metrics are currently at their highest level in a generation, with the consumer price index in the United States rising to a 40-year peak of 8.5%, year-on-year, and the Eurozone equivalent coming in at 7.5%, its highest level on record. Though the corresponding UK figure of 7.0% is slightly lower, it still represents a 30-year high and, along with the US and Eurozone data, is significantly above the 2% central bank target. Though there has been 12 consecutive months of US CPI Y/Y releases above the Fed’s 2% inflation target, it is only the last four months that the core reading for this measure has exceeded 5%.

Unsurprisingly, this has ramped up the pressure on central banks to rein in inflation via monetary policy tightening. In March, the Federal Reserve delivered its first rate hike since December 2018 and the Bank of England raised the base rate for the third time in four months. Though the European Central Bank is yet to embark on lift off, recent rhetoric has been increasingly hawkish and received as clearly signalling movement in the same direction.

It is expected that the tightening cycle for both the Fed and BoE will be front loaded, initially hiking rates aggressively before levelling off. Current market pricing points to a year-end fed funds rate of around 2.5%, meaning approximately 200bp of further tightening. With six scheduled meetings remaining in 2022 this would mean at least one 50bp hike, with the next meeting in May looking a likely candidate at present. For the ECB, two 25bp hikes are expected this year, which would take the deposit rate back to 0%.

The war in Ukraine, more Covid-driven supply bottlenecks - especially in China - and the sharp rise in interest rates all understandably worsen the outlook for companies’ profits in 2022, though perhaps surprisingly, the consensus forecasts for Q1 results haven’t really been adversely affected, on the whole.

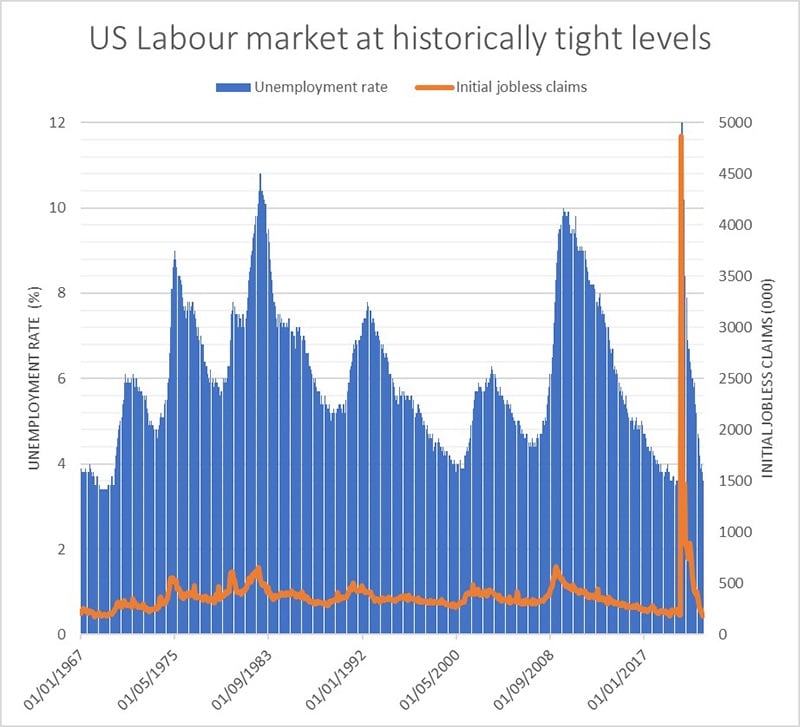

Earnings updates will be scoured for inflation references and the ability of firms to pass on rising input costs to consumers. The most recently released transcripts showed a marked and significant increase among US companies in the use of terms such as “higher/raising wages”, “labour cost” and “labour shortage”. These are all closely related to tight labour markets and the latest data on jobs is suggestive of extremely tight conditions.

Source: Refinitiv Datastream

US weekly jobless claims fell to its lowest level since 1968 last week at 166k and the latest unemployment rate of 3.6% is just 0.1% off the Fed’s communicated level of full employment. While an economy running too hot is perceived to be the chief driving force of inflation in the US, for the Eurozone and UK the conflict in Ukraine and associated commodity shock are playing a greater role.

That said, there are reasons for cautious optimism. Base effects should start to increasingly weigh on headline inflation given that it is almost a year since US inflation began its march higher in earnest, when last May’s CPI release came in at 4.2% and well above forecasts. Furthermore, expectations play a pivotal role in driving inflation and the degree of monetary tightening priced into markets in the coming months speaks volumes as to the perceived intentions of central banks. Put simply, people are predicting aggressive inflation-targeting actions from central banks for the rest of the year.

The outcome of the conflict in Ukraine remains highly uncertain but it is worth noting that some of the initial market reactions have faded, with oil benchmarks, for instance, paring a significant portion of their gains and residing a fair distance from the recent peak. While it would be a bold call to predict inflation is on the verge of peaking, significant downward pressure is being applied from central bank policies and base effects, while the pullback of several commodity markets from recent highs may mean one of the key driving forces for higher prices is beginning to abate.

Subscribe to one of our newsletters

Get the inside view from Quilter Cheviot delivered straight to your inbox.