Weekly podcast – Market overview

This week’s host, Investment Manager Jack Bishop, discusses recent market turbulence with Global Technology Analyst Ben Barringer. Among the topics discussed – the effects of Trump imposed tariffs, details on these tariffs, fixed income remaining a safe haven asset and much more.

This is a marketing communication and is not independent investment research. Financial Instruments referred to are not subject to a prohibition on dealing ahead of the dissemination marketing communications. Any reference to any securities or instruments is not a personal recommendation and it should not be regarded as a solicitation or an offer to buy or sell any securities or instruments mentioned in it. This material is not tax, legal or accounting advice and should not be relied on for tax, legal or accounting purposes. Quilter Cheviot Limited does not provide tax, legal or accounting advice. You should consult your own tax, legal and accounting adviser(s) before engaging in any transaction.

Market overview – Caroline Simmons, Chief Investment Officer

Global stock markets have begun the new week in much the same vein as they finished last week, with heavy selling seen in Asian markets and European indices, in particular Germany, falling lower. Bonds remain well supported on safe haven flows and are providing some cushioning for multi-asset portfolios.

There was little by the way of new developments over the weekend and the key driving force remains the fallout from last week’s tariff announcements. While the initial market reaction was moderately negative, the sell-off intensified in the following hours and days as more and more investors seemingly came to realise that this was not a kind of shock therapy intended to bring about negotiations — the US administration are apparently committed to implement the measures.

Heading into the announcement from Donald Trump the market expectation was for a weighted average tariff rate in the 10%-20% range and it is clear that what was delivered is significantly above and beyond this.

Tariffs:

- All US imports will be subject to a 10% tariff, effective 5 April

- Targeted nations will receive a higher “reciprocal” tariff rate, effective 9 April. For example, a 34% duty will apply to China, 20% for Europe and 24% for Japan.

- Tariffs will be stacked, meaning that effective tariffs will be higher — the base rate on China will be 54% (new 34% tariff plus current 20% tariff)

- 25% tariff on cars made outside the US, effective 3 April

Economic impact

The direct impact of tariffs on company earnings varies by sector and region. Country equity market indices have varying degrees of exposure to their underlying economies, but the potentially wider reaching implications are around overall impacts for economic growth and second order impacts of a growth slowdown should all tariffs remain in place (which seems unlikely given Trump’s comments of being open for negotiation).

We see the latest developments as negative for US and global growth and therefore detrimental to future equity returns, everything else being equal, hence the risk-off market reaction.

China retaliated on Friday 4 April with a 34% tariff levy and it seems like the world’s two largest economies are not keen to backdown. There have been reports of smaller economies contacting the White House to offer negotiations to lower rates, but at the time of writing nothing official has been confirmed.

One positive is the strong growth backdrop going into this external shock, with the consensus at the start of the year looking for 2.2% real GDP growth in 2025. Should the full tariffs remain in place until year end then economists estimate a 1%-1.5% hit to growth, which increases the chances that a quarter or two are close to 0. Friday’s employment report provided further evidence of the strength of the US economy before the substantial escalation in tariffs.

It’s a similar theme with earnings, where strong starting mean that even with sizable downside revisions there is still an expectation for profits to grow this year. The US was forecast earnings growth of around 12% and Europe 7%, and factoring in the full impact of those tariffs would likely bring both down to the low single-digits.

Uncertainty rises

The situation is obviously fluid and subject to change — we have already seen how Trump has used tariff threats to extract political concessions from Canada and Mexico. Rather than “liberation day” providing clarity for investors, it has in effect increased uncertainty. It appears that Trump is seeking to negotiate and draw concessions with the factsheet containing a line stating: “These additional ad valorem duties shall apply until such time as I determine that the underlying conditions described above are satisfied, resolved or mitigated.”

Market reaction

Equities move lower

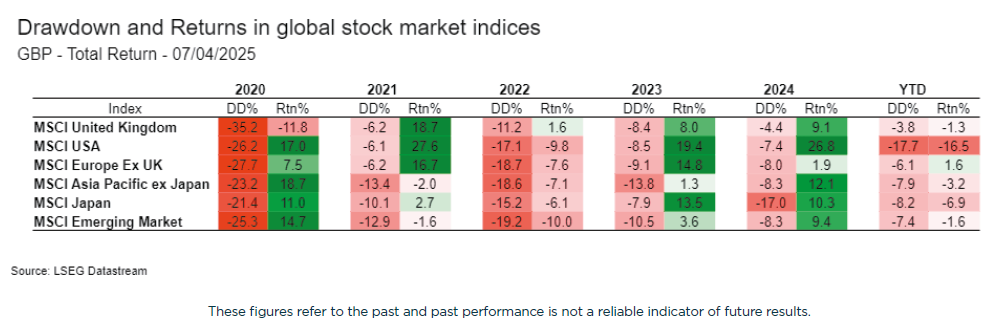

The sell-off in stocks has been dramatic and made plenty of headlines. The moves lower have been exacerbated by investors being seemingly caught off guard and not expecting Trump to push through such stringent measures. US stock benchmarks fell just under 10% last week, for the worst weekly return in five years. Still, it is worth keeping in mind that the closing level on Friday was only around 2% below the low seen in August 2024. European stocks have also experience sizable declines, erasing the gains seen in recent months and edging into negative territory for the year but still holding up better than US counterparts.

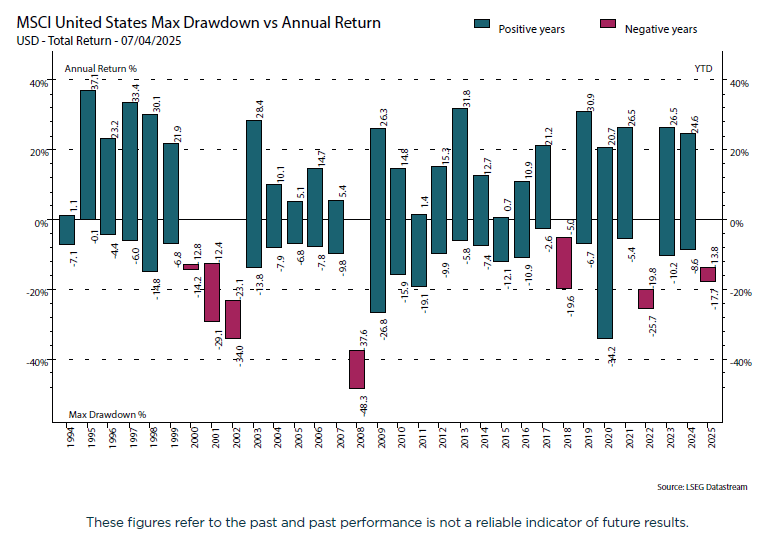

While recent moves are larger than typical, market drawdowns are common occurrences and happen even during good years for stocks.

Volatility has picked up sharply and, with the increased level of uncertainty, larger daily moves are occurring. While the last few days have been to the downside, we are aware that many of the largest stock market rallies occur against a backdrop of sharply falling prices and high volatility. This is why knee-jerk reactions following adverse market moves can be so damaging to long-term returns, as some investors can panic and abandon their strategy at the worst time.

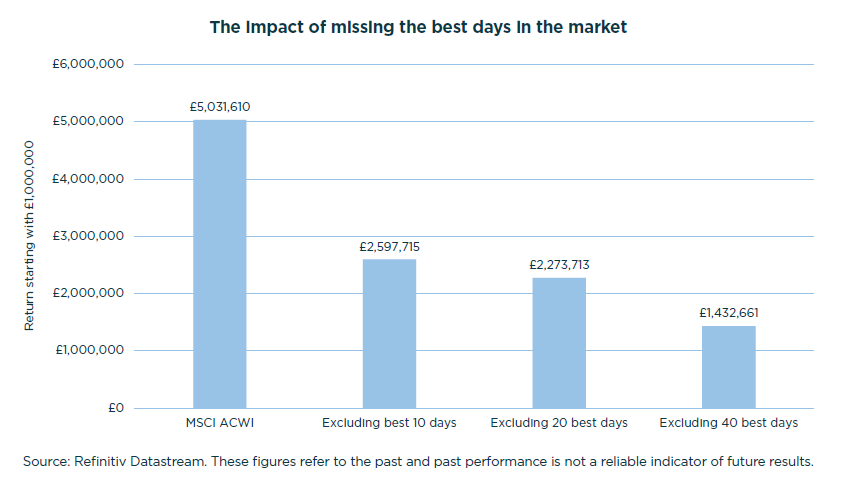

Looking at the MSCI All Country World index over the last 25 years (31/12/99 - 04/04/2025) demonstrates how costly it can be to miss the best days in the market. Starting with £1m invested, missing just the 10 best days in the market would almost half your return during this period.

Fixed income remains safe haven asset

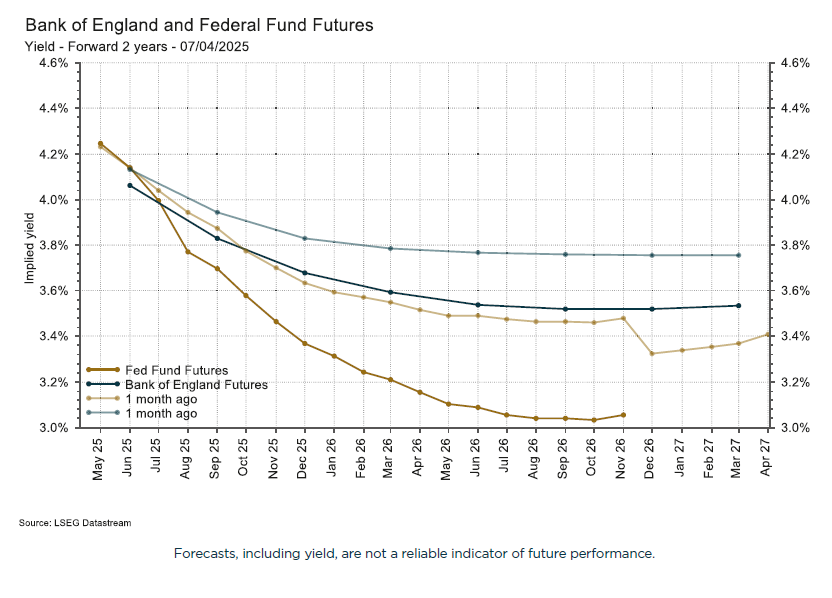

Fixed income has performed well in recent sessions, as bond prices have rallied in response to the tariff news. Federal Reserve chair Jerome Powell struck a fairly neutral tone during remarks on Friday, but the market is expecting additional rate cuts going forward. Derivatives markets are now pricing around 1.25% of cuts in 2025, compared to 0.50%-0.75% before the tariff escalation. This has particularly helped the short end of the yield curve. The Bank of England is also now expected to have a lower end of 2025 rate, somewhere in the region of 3.7% versus 3.9% a month ago. The current BoE base rate is 4.5%, the same as the Fed funds rate.

The tariffs themselves are seen as inflationary (economists estimate they will add 1.0%-1.5% to inflation this year), but a slowing economy and falling oil price will work in the other direction. There was a sharp drop in oil last week, with brent crude falling over 10% to trade in the mid US$60s a barrel and around its lowest level in four years. There were also some large moves in the US dollar, although on the week it ended little changed. The initial reaction saw US dollar weakness (GBP/USD rose to US$1.32 — a 7-month high) but this reversed on Friday as strong US data and further risk-off moves in stocks caused a recovery.

The benefits of a diversified, multi-asset approach can be seen in the comparison below.

While several individual markets are experiencing fairly significant drawdowns, a balanced portfolio (PIMFA balanced) is only down mid single-digits year to date.

Conclusion

In the meantime, we remain steadfast in our belief that our long-term approach to constructing multi-asset portfolios is optimal. The strong performance of bonds in recent sessions shows their diversification benefits during times of market uncertainty while the positive returns from European equities year-to-date speak to what can be gained from geographic diversification.

We believe in the importance of maintaining an analytical approach and avoiding emotional, knee-jerk reactions that have proven to lead to worse investment outcomes over time. Volatility has clearly increased as sentiment has soured, but we remain committed to cutting through the noise and focusing on market fundamentals. We will be continually monitoring developments as and when they occur and continue to provide timely updates where possible. If you have any specific questions, please don’t hesitate to contact your investment manager to discuss further.

Authors

To listen to all the past Weekly Comment podcasts click here or subscribe via the apps below: