The Autumn Budget has been one of the most keenly discussed UK fiscal events in several years, marking a substantial change in the approach to public finances. Therefore, I was delighted that Adam Smith, former Chief of Staff to the Chancellor of the Exchequer joined myself and James Hughes, fellow Taking Stock podcast co-host, to share some words of wisdom from his time in Whitehall.

Jonathan Raymond:

This budget has been about as eagerly anticipated as any I can remember in my 20-year career. Just how big an event was it?

Adam Smith:

In my opinion it’s a really significant event and has certainly lived up to the billing. We’ve just witnessed the largest fiscal loosening in 30 years and biggest set of tax rises in a generation, so it is clearly a big deal. The government also plans to borrow approximately £30bn more each year to fund this large increase in government spending.

Jonathan Raymond:

There has been much discussion around the benefits and drawbacks of such a landmark change in fiscal policy. How do you think the chancellor will be judged on this budget?

Adam Smith:

In my eyes, Rachel Reeves was trying to achieve three things with this announcement.

- Place some blame on the previous government for the challenging fiscal position.

- Avoid a return to austerity, meaning real spending cuts for governmental departments.

- Invest to increase future economic growth.

It’s obviously very early to draw any hard conclusions on this, but my initial reaction is that Reeves has achieved mixed successes on these goals.

Firstly, the office for budget responsibility (OBR) released a separate report on the same day as the budget that failed to verify the £22bn black hole in public finances that Labour claims it inherited. They also didn’t dismiss it out of hand, so I suppose you could say the jury is still out to some extent on this.

On the second aim, there is no immediate return to austerity with significant spending increases announced. However, these increases appear front-loaded, far higher in the next two years before falling away to tight levels again. This is likely based on the chancellor seeking to meet fiscal rules of falling debt by the end of the parliament but does leave the question of whether austerity has been avoided, or merely postponed.

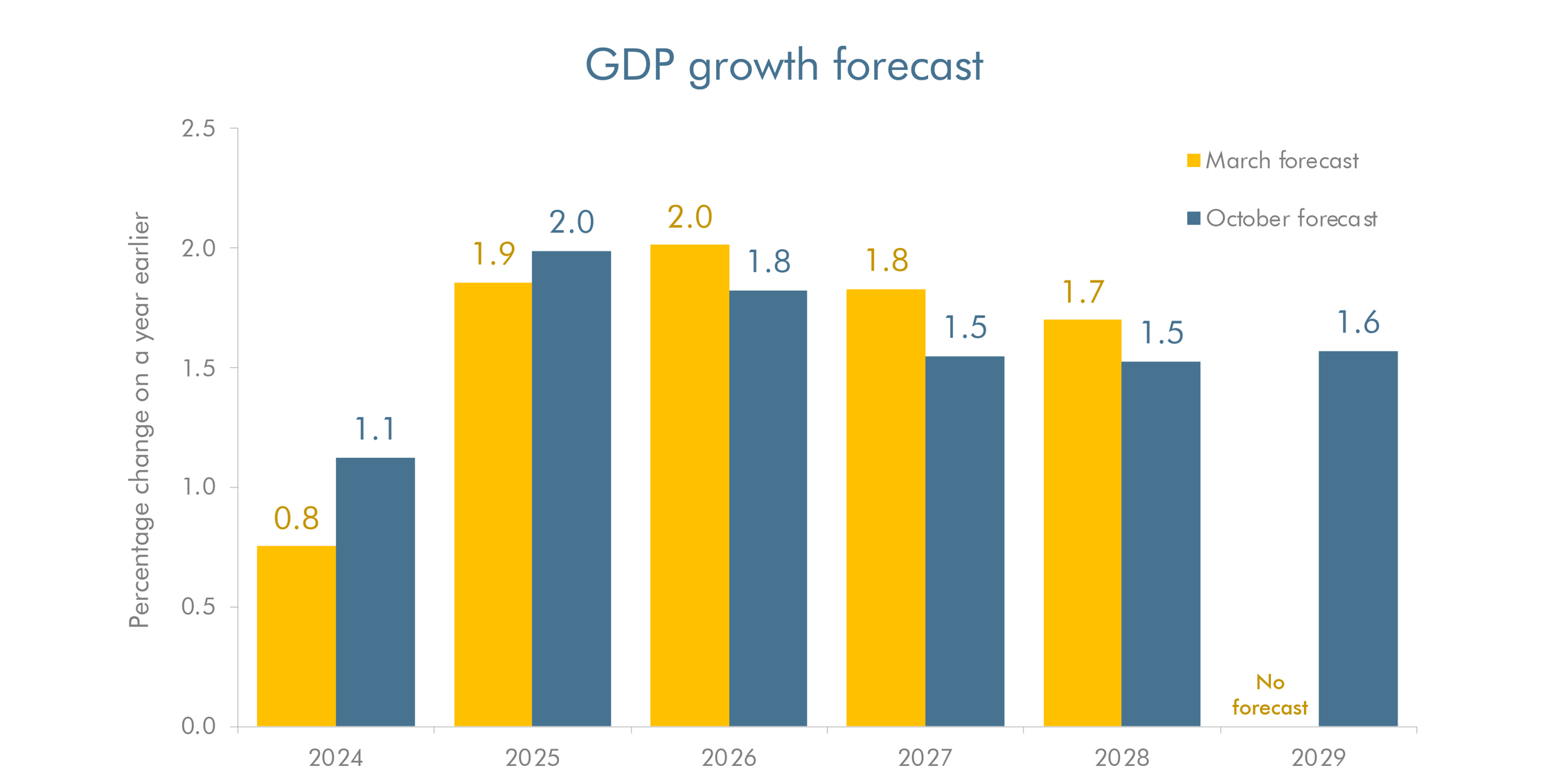

Regarding economic growth, the OBR forecasts a short-term boost but then lower growth than in its March forecast. There is the caveat here that the OBR mentioned its March forecast would likely be different if they were aware of the previous governments overspend, but the scale of this overspend — £9.5bn of which has been verified by the OBR — is in my opinion unlikely to have made a major difference to the growth prospects. The near-term boost in growth is a direct result of the sizable increase in government spending, which leads to lower medium-term growth as it fades away. I’m hoping the OBR is wrong on the medium-term growth forecasts, otherwise we may be looking at further tax rises in 1-2 years in order to avoid a return to austerity.

Jonathan Raymond:

Turning to financial markets, how have investors taken the news?

James Hughes:

Initially as the headlines came through there seemed to be a sense of relief from the market. While there were several significant changes, most of these were telegraphed well in advance so there were not too many surprises. Areas of concern like CGT (capital gains tax) and business relief ended up being better than most of us expected.

There was a reasonable rally in UK stocks on the day of the announcement, particularly in the mid-cap space which is more sensitive to the UK economy than its large-cap counterpart. AIM, the UK’s junior stock market, responded positively rising 4.1% for its best daily return since April 2020. This is a reflection of the worst-case scenario being avoided, with some IHT relief remaining, albeit at half the previous rate. We’ve spoken to a number of fund managers in the space in recent months who have been keeping powder dry and now may be looking to put that back to work.

If you’re looking for potential negative reactions, the move higher in government bond yields is something to keep an eye on. Short-dated gilt yields rose about 20 basis points, as less policy easing from the Bank of England was priced in due to the budget being seen as raising inflation.

The 10-year gilt yield hit its highest level of the year around 4.5%, up around 30 basis points from its low while Reeves was speaking. This is likely a reflection of increased borrowing and maybe some expectation that there will be even more borrowing in a few years’ time given the lack of fiscal headroom.

There has also been a move lower in sterling, down about 1.2% in trade-weighted terms in the 24 hours following the announcement. While this is and the rising bond yields are a negative reaction, it should be pointed out that at present they are far more contained than the fallout from Kwarteng’s “mini-budget” just over two years ago.

Jonathan Raymond:

Yes, I’ve seen several headlines regarding the negative market reaction but for now it still pales into comparison to the move in September 2022, doesn’t it?

James Hughes:

Yes, it’s been far more calm and collected than the mini-budget under Truss. There are some similarities in the backdrop though. Coming into the budget there has been a substantial increase in global bond yields, like we saw in 2022 when central banks were hiking rates to fend off inflation. This time around the rising yields are mainly a US phenomenon, with stronger US data and the seemingly increasing possibility that Trump wins the US election and delivers a larger increase to the US budget deficit.

Having said that, the backdrop now appears to be less concerning. In 2022 it was a bit of a case of Kwarteng and Truss walked into a shed full of fireworks and lit the match. The currency moves are arguably the best indication of a UK-specific market response and for now they’re far more subdued than they were a couple years ago, with bond and equity markets more reflective of overseas factors.

Jonathan Raymond:

How closely does the Treasury monitor the market reaction to these kinds of events?

Adam Smith:

From my experience, very closely indeed. We used to watch markets carefully when I was working in the Treasury, particularly after a fiscal event. we would get daily market summaries, showing the latest moves and what impact this had on debt interest payments.

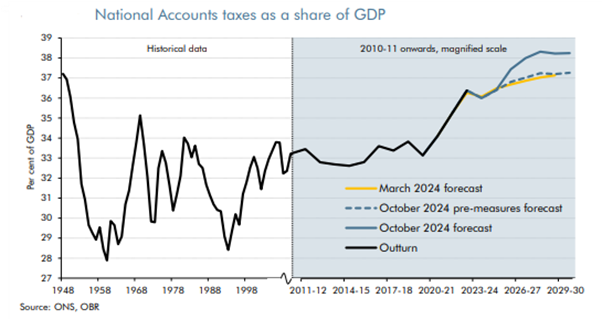

The OBR said that these payments are now in the region of £100bn a year and any continued increase in yields will push that cost up further. The higher this cost the less money for other government spending.

Jonathan Raymond:

I’ve picked out a few charts from the latest budget and was wondering what your thoughts were on them?

Source: OBR

Adam Smith:

This one is showing that the increase in employer national insurance will reduce growth in each year after 2026. I find it quite strange they would’ve known about this detrimental impact on growth and keep saying that growth is their number one mission.

Reeves claimed that numbers from March meant prior forecasts not accurate. This goes to the heart of the £22bn black hole discussion. The OBR said £8-9bn of the overspend unknown and that meant that forecasts would’ve been different. But the size of the impact on a £1tn budget is probably not that large in terms of the impact on growth.

Jonathan Raymond: What can the chancellor do from here to kickstart growth?

Adam Smith:

There are positive things Reeves has already done, such as to increase capital investment. OBR give GDP benefit for that. I think the planning reforms could also boost growth but from my experience the OBR has never historically changed growth forecasts on planning changes.

From my time in the Treasury, I know OBR recognised the extension of free childcare on growth — they upped growth forecasts when the Conservatives did that. They also gave an increase to the GDP forecast for NI cuts. I believe the OBR does try to acknowledge supply side benefits and that it gets unfair criticism for not doing that.

But, in my opinion, in this budget the benefits from capital spending are outweighed by the national insurance increase. I expected to see a bit more spending on productive assets that would increase growth rate. Transport projects, energy infrastructure, broadband rollout. Schools and NHS seem to have the lions’ share of funding.

Adam Smith:

It’s a classic tax/spend budget. I don’t think anyone is really surprised that labour put up tax and spending and most people would agree that public services need more funding. The surprise, if anything, comes from the scale and profile of the spending. Spending goes up quite a lot over the next two years but then tails off significantly.

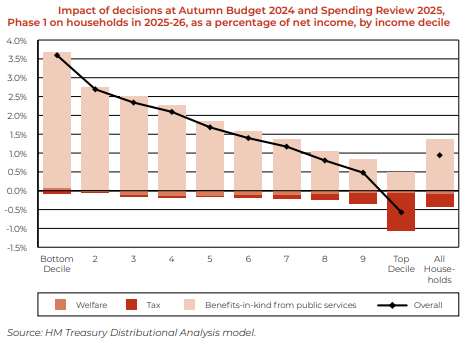

This shows the distributional impact of the tax rises. It shows the top decile of households by income facing the biggest cost, such as tax on private schools. I think the chancellor would’ve been quite pleased with this chart and when we were in the Treasury, we’d often look at these charts to assess the impact of tax changes. However, the threshold changes in national insurance will hit the lower earners more as the allowance is removed.

Jonathan Raymond:

Thank you very much for your insights. In conclusion, I want to make a final point on pensions which have been brought into scope for IHT from April 2027. Pensions have been used as a vehicle for passing on wealth since the pensions’ freedoms act in 2015.

Our understanding is the pension itself will pay any IHT due. For me the most surprising aspect is that under current measures, having paid IHT on pension, beneficiaries will have to pay income tax on the amount that comes out.

For instance, that would mean a £1m pension pot charged 40% IHT would leave £600k for the beneficiary. The beneficiary would then pay their income tax rate on the remainder they draw out which could be a maximum of 67% effective tax on the pot, if the beneficiary is an additional rate taxpayer. At present spousal exceptions apply to inherited pensions.

Our view is to wait until the consultation on these things. Also, this party is only in power for five years at present and things can change in the future. There is no need to make any rash decisions.

Something that could be done that would likely be of benefit is consolidating all pensions into one pot. Pensions aren’t always the most administratively efficient organisations.

Speakers

Subscribe to Taking Stock - Diary of an Investment Manager

Get the inside view from Quilter Cheviot Investment Manager, Jonathan Raymond, in his fortnightly diary.