Cash savings are a safer bet

Cash can feel like a safer bet as you can see it and feel it. And for most of the past three decades, the interest rate that banks have paid on savings has been above that of inflation, meaning it has increased in value over time.

But more recently, even though interest rates on savings accounts are rising, they currently remain well below the level of inflation. This means that cash deposits have been losing value in real terms in recent years, once the effect of inflation is taken into account, as the chart shows.

Inflation: recognising the cost of cash

It can be difficult to connect the impact of inflation with cash in the bank. But rising prices have a very real effect on your savings. Even a relatively modest inflation rate of 2% – the Bank of England’s target – means that your money loses a third of its purchasing power over 20 years. With inflation surpassing 10% in 2022, there’s a heightened risk of the value of cash being eroded.

This is an important factor to remember, especially if your view of investing is that you could lose money. While there is inherently risk in investing, this can be managed in line with risk preferences and mitigated with a long-term investment horizon.

There’s little you can do to your cash to make it beat inflation, especially if the rate at which prices are rising is higher than the best savings account interest rate. Conversely, a long-term, diversified investment plan improves your chances of producing returns that outpace inflation.

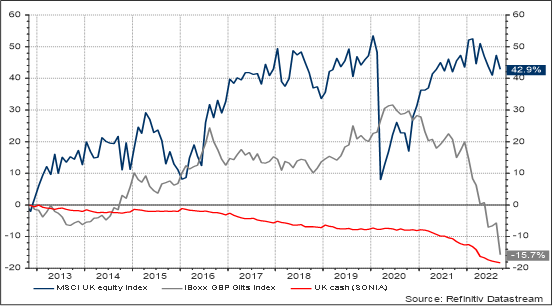

To see how investors beat cash savers over long timeframes, the chart below compares cash savings and investment returns over the past 10 years. Chart 2 shows the nominal return of cash (i.e. before the effects of inflation), UK government bonds and UK equities in the past decade to the end of 2022.

Chart 2: Nominal returns of UK Cash, Government Bonds and Equities.

An investment can match your own level of risk

Choosing to invest your money over keeping it in cash is not a binary high-risk/low-risk decision. Investors have the luxury of targeting a level of risk that suits them, and while the value of any investment can go down as well as up, the likes of government bonds or infrastructure have historically been less volatile than equities.

The prospect of any loss can make cash seem more compelling, but this is only if you ignore the detrimental impact inflation has on cash savings. Even modest inflation can erode cash-based wealth, and during dramatic spikes, even the best savings accounts are unlikely to have rates that beat, or even match, inflation.

To better understand this, the charts below look at nominal and real returns. Nominal returns of cash or investments can be flattered by inflation, because if prices rise, the value of investments should appreciate too, while the performance of cash is flattered because nominal returns ignore what that cash can actually purchase – they ignore the impact of inflation.

But when you look at real returns, this takes into account what an asset like a government bond or an equity has returned after taking inflation into account. You will see that the returns are lower in Chart 3 than Chart 2 as they consider the impact of inflation.For more information on investing, download our Lessons from History guide, or fill in your details to talk to one of our investment managers.

Chart 3: Real returns of UK Cash, Government Bonds and Equities.