The UK budget and US elections are two major events for financial markets in recent weeks and quite rightly dominated the news headlines. The initial market reaction has been positive for equities, with US stock benchmarks rallying to new record highs. UK gilts have not fared quite so well, as yields have risen on the expectation of additional supply to fund more government borrowing and higher inflation. That said, the yield levels on offer, in the 4%-5% region, are increasingly attractive.

Before looking in more detail at the impact the UK budget and US election will have on markets going forward, it is worth looking at the current state of play. The last 12 months have been a rewarding time for investors, with most markets providing positive returns as central banks eased monetary policy and inflation fell back.

In the 12 months to 31 October 2024, the MSCI All Country World index rose 26.3% (all returns in sterling, unless stated otherwise). US equities have been the standout performer, rallying 30.6% but there has also been pleasing returns from the MSCI UK (16.0%) and MSCI Europe ex UK (16.7%). Although the environment has not been the most conducive to fixed income investments — central banks have generally pursued a slower and shallower rate-cutting path than previously expected — the iBoxx gilts index has still returned 5.5%. Among most major markets, the only significant faller in the past 12 months has been Brent crude oil (-16.3%), which in itself is a helpful factor in easing inflationary concerns.

While the past 12 months contained a number of unexpected developments, the macroeconomic paradigm has been fairly consistent. Central banks have been lowering interest rates, inflation has continued to fall back towards target and economic activity continues to hold up fairly well, on the whole. This backdrop has supported better-than-expected corporate earnings and underpinned the strong stock market performance. The question now for investors is whether recent developments significantly alter this dynamic and, if so, in what fashion.

Rising taxes, borrowing and spending

The UK budget marked a significant change in the UK’s fiscal position with plans to increase government spending by approximate £70bn per year — funded by an additional £40bn from taxes and £30bn from additional borrowing.

An in-depth summary of the budget can be found here.

This is expected to boost economic growth and raise inflation slightly in the first two years, with the OBR (Office for Budget Responsibility) forecasting real GDP growth in 2025 to rise by 0.5% to 2% and the consumer price index to be 0.4% higher in 2026.

The longer-term impact of the plans remains uncertain and Rachel Reeves, UK chancellor, faces a delicate balancing act with minimal fiscal headroom. The change to the fiscal rules to allow for greater borrowing has received IMF support, but with bond yields rising significantly in recent years the hurdle rate for productive investment has also moved substantially higher.

It’s hard to see the budget as pro-growth when the majority of the additional tax revenue will come from a levy on the cost of employment and seemingly front-loaded government spending plans, with substantial increases up to 2026 fizzling out in subsequent years to make the books balance by the end of the government’s term. The overall tax burden is scheduled to rise to its highest level on record by the end of the decade, reaching 38% of GDP.

A closer look at the sector-by-sector impact of the UK budget can be found here.

Although markets were forewarned of many of the most important tax changes, there was a notable reaction in bonds as yields pushed higher, seemingly on the prospect of higher-than-expected borrowing. That being said, the reaction to the largest fiscal loosening in a generation was measured and a far cry from the pandemonium that ensued just over two years prior following Liz Truss’s “mini” budget.

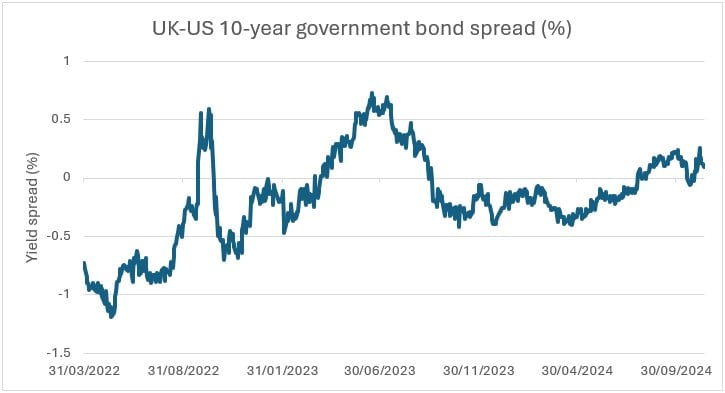

Although UK gilt yields have moved up close to their highest levels since the 2008 global financial crisis, this is almost entirely due to factors pre-dating the budget. A comparison to the US treasury market reveals that most of the recent gilt moves are not reflective of UK-specific factors.

The UK 10-year gilt yield currently has a spread of around 10 basis points over the US equivalent, a similar level to that seen during most of September. While this spread has risen from a low of -40 basis points in April (US 10-year yielding 40 basis points over 10-year gilts) it is still well below the +65 basis point level seen in July 2023. This suggests that talk of a lingering “risk premium” in UK government bonds is misplaced.

Source: Bloomberg

Trump to return to the White House

For many investors the US election is of greater importance than the UK budget, given the geopolitical and macroeconomic implications of the result encompassing global trade, wars in Europe and the Middle East, global inflation and interest rates.

Along with Donald Trump winning the presidential election, victory for the Republicans in the Senate and House of Representatives completes a trifecta that means limited opposition in implementing policies. So-called “Trump trades” have benefitted in response to the outcome, with US stock benchmarks surging to new all-time highs while the US dollar and Treasury yields also gained.

These moves can be explained by the market pricing-in a sizable fiscal loosening, with the Trump administration expected to boost demand via sizable tax cuts and government spending. Meanwhile, the expectation of more stringent tariffs is seen as restricting the supply side of the economy. Together, these policies are seen as increasing inflation and government borrowing, suggesting relatively higher (or less low) interest rates than previously expected.

There remains a high degree of uncertainty as to how exactly these changes will be implemented and the devil will be in the detail. If we assume 10% tariffs across the board in 2025, this could potentially add up to 1% being added to the inflation rate. On corporate earnings a proposal to cut corporation taxes, whereas the Democrats were planning increases, has provided a positive boost to the near-term outlook. Some estimates place this as increasing earnings per share by 4%-8%.

A corporate rate tax as low as 15% for domestic production could provide a boost in particular to small-cap index earnings and this has contributed to their outperformance since the result became known. Small- and mid-cap businesses are seen as the best-placed beneficiaries of Trump’s “America first” agenda. These stocks are still currently undervalued compared to large caps, largely due to the exceptional performance of mega cap tech and large pharma companies in recent years rather than a reflection of their own fundamentals.

However, the potentially higher degree of uncertainty going forward and a further move higher in bond yields would disproportionately impact small caps, as they typically have smaller cash buffers and higher debt levels. The US 10-year Treasury yield hit 4.48% following the election, rising around 15 basis points but this has since reversed with the market back at pre-election levels. That said, yields had risen significantly in the weeks leading up to polling day and the short-term reaction could be more a result of profit taking rather than a market turning point.

The initial market reaction has been quite clear — stocks up, bond yields up, US dollar up — but we await further information to guide us in assessing the long-term impact. The extent to which Trump delivers on his proposed policies remains to be seen. Trump prides himself on being a dealmaker and his stance on universal tariffs, for instance, could well be seen more as a negotiating starting point than a set-in-stone position. In the coming weeks whoever Trump chooses for key roles such as the Treasury secretary and secretary of state will provide further detail on the likely policy direction going forward.

Subscribe to one of our newsletters

Get the inside view from Quilter Cheviot delivered straight to your inbox.