The British investor

Synonymous with a more careful and strategic approach, often prioritising long term stability. But how do our methods compare to the bolder, risk taking American investors, or the sustainability-focused continental Europeans? Let’s dive into the key differences and discover what we can learn from our counterparts.

When it comes to investment participation, the US stands out with 60% of the population investing, compared to 46% in the UK and 48% in Europe. Women in the US also lead the charge with a 48% participation rate, outpacing their counterparts in the UK (29%) and Europe (33%). So, what’s driving this high participation in the US?

- Financial education: The US has the world’s largest capital markets, raising awareness and interest in financial education that encourages higher participation rates. With financial literacy programs and resources readily available, it’s easier for individuals to understand and engage in investing.

- Access to investment platforms: In the US, there’s a smorgasbord of investment platforms and tools, making the process of investing a breeze. This accessibility lowers the barrier to entry and entices more people to join the investment game.

- Cultural emphasis: American culture celebrates financial independence and wealth-building. The allure of the “American Dream” motivates individuals to invest as a means of achieving financial security and prosperity, a stark contrast to the more reserved approach of Europeans.

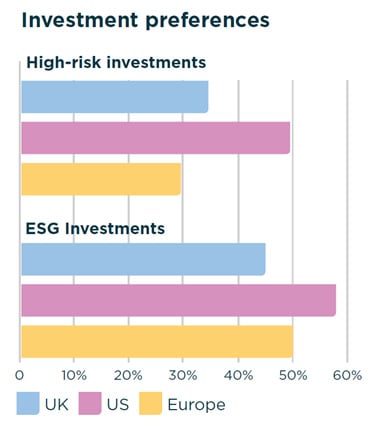

Investment preferences

US investors are the thrill-seekers of the investment world, with a higher preference for high-risk investments (50%). This can be attributed to the US’s dynamic and innovative financial market, which offers a plethora of high-risk investment opportunities. Financial education also plays a role as investors are more comfortable taking on more risk where they deem they will receive more reward.

Whereas in Europe, the growing awareness and demand for ESG (Environmental, Social, and Governance) investments reflect a societal shift towards sustainability and ethical investing. The greater proportion of US investors in ESG-related assets is perhaps surprising. This could be partly explained by a potential greater willingness to invest in new areas but may also be a result of less robust classification as Europe follows more stringent criteria in categorising an investment in this space. Here’s why preferences vary so much:

- Market dynamics: The US financial market is a hotbed of dynamism and innovation, attracting investors willing to take on more risk for the potential of higher returns.

- Sustainability awareness: In Europe, there’s a strong cultural and regulatory emphasis on sustainability and ethical investing. This has led to ESG investments mirroring societal values and regulatory frameworks that prioritise sustainability.

- Conservative approach: UK investors are the cautious strategists, often preferring low-risk investments. This conservative approach is influenced by a desire for long term stability and a historical preference for safer investment options.

Investment confidence levels

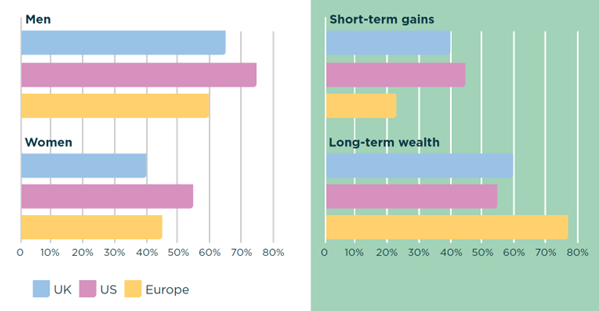

Confidence levels in investing are higher among men than women across all regions. In the US, 75% of men feel confident in their investing abilities compared to 55% of women.

The UK and Europe show similar trends, with men being more confident than women, albeit at lower overall levels of confidence. Here’s what influences confidence levels:

- Societal norms: Societal expectations and norms play a significant role in shaping confidence levels. In the US, there’s a greater cultural acceptance of risk-taking, which boosts confidence among investors.

- Financial education: Higher levels of financial education in the US contribute to greater confidence in investing abilities. Knowledge and understanding of financial markets empower individuals to make informed investment decisions.

- Gender dynamics: Across all regions, men tend to be more confident in their investing abilities than women. This confidence gap can be linked to historical underrepresentation of women in the financial sector and differences in financial education and societal expectations.

Investment goals

Continental European investors – particularly women – are the long-term planners, with 77% focusing on long-term wealth compared to 23% on short-term gains. This contrasts with the UK and US, where the focus is more balanced between short-term and long-term goals. Here’s why the focus varies:

- Economic stability: European investors, particularly women, are more focused on long-term wealth due to a more conservative investment culture and a stronger social safety net. This reduces the need for immediate financial returns and encourages a focus on long-term financial security.

- Cultural values: In the UK and US, there’s a more balanced focus between short-term gains and long-term goals. This balance reflects a blend of cultural values that prioritise both immediate financial success and long-term stability.

What can we learn?

In conclusion, as British investors, there are valuable lessons to be learned from both continental European and American investors:

- Embrace financial education: A robust financial education system plays a crucial role in the higher US investment participation rates. Check out our articles section on the Quilter Cheviot website, which offers a broad range of topics across both financial planning and investing.

- Consider higher-risk investments: While maintaining a cautious approach, exploring high-risk investments can offer higher returns. Learning from American investors’ boldness can help diversify portfolios and potentially increase gains.

- Consider sustainability: European investors’ emphasis on ESG investments reflects a growing trend towards sustainability. Incorporating socially responsible investments can align financial goals with potential ethical values while still contributing to long-term wealth.

- Balance short-term and long-term goals: European investors’ focus on long-term wealth is a valuable lesson. While short term gains can be appealing it is ultimately long-term results that help reach long term goals, providing financial stability and growth over time.